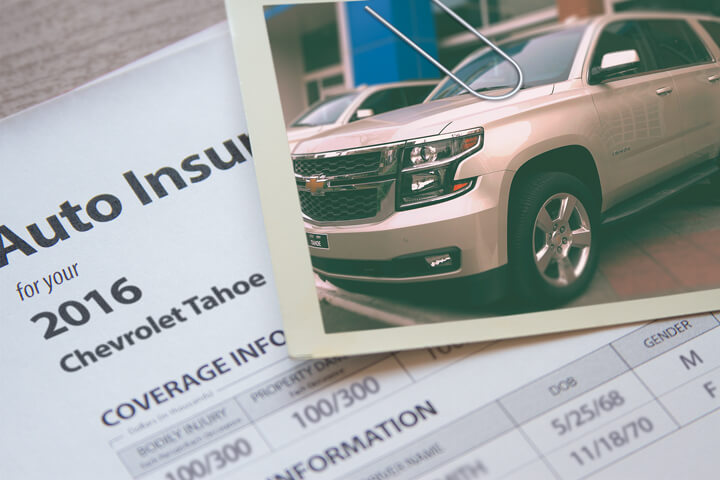

Chevy Tahoe insurance rates image courtesy of QuoteInspector.com

Feel like you're a prisoner to an expensive auto insurance policy? Say no more because there are many people just like you.

Feel like you're a prisoner to an expensive auto insurance policy? Say no more because there are many people just like you.

Unimaginable but true, almost 70% of insureds have purchased from the same company for at least the last four years, and just short of a majority have never compared auto insurance rates at all. With the average premium in Illinois being $1,500, drivers could pocket roughly $586 a year just by shopping around, but they mistakenly think it's difficult to find lower-cost rates by getting comparison quotes.

Many insurers compete for your insurance dollar, and because of this it can be hard to compare insurers to find the absolute best rate on Chevy Tahoe insurance in Chicago.

If you already have coverage, you should be able to buy cheaper car insurance using these tips. Finding the cheapest car insurance coverage in Chicago can be made easier if you know where to look. Nevertheless, Illinois car owners should learn the methods companies use to compete online and use it to your advantage.

Companies offer many discounts on Chevy Tahoe insurance in Chicago

Not many people think insurance is cheap, but companies offer discounts that may help make it more affordable. Some discounts will apply when you get a quote, but occasionally some discounts must be requested specifically before they will apply.

- Use Seat Belts - Buckling up and requiring all passengers to fasten their seat belts can save 10% or more on medical payment and PIP coverage.

- Multi-car Discount - Buying coverage for multiple vehicles on a single policy can reduce rates for all insured vehicles.

- Buy New and Save - Insuring a vehicle that is new can save you some money compared to insuring an older model.

- Lower Rates for Military - Having an actively deployed family member could trigger a small discount.

- Life Insurance - Insurance companies who offer life insurance give better rates if you take out a life insurance policy as well.

- Own a Home and Save - Owning a home in Chicago may earn you a small savings because maintaining a house means you have a higher level of financial diligence.

- No Charge for an Accident - Not a discount per se, but a handful of insurance companies will let one accident slide without getting socked with a rate hike so long as you are claim-free prior to the accident.

- Safe Driver Discounts - Drivers who avoid accidents could pay up to 40% less than their less cautious counterparts.

- Low Mileage - Low annual miles may enable drivers to earn discounted rates on garaged vehicles.

- Employee of Federal Government - Active or former government employment can save as much as 8% but check with your company.

Just know that most credits do not apply to the entire cost. Most only reduce the price of certain insurance coverages like collision or personal injury protection. Just because it seems like all those discounts means the company will pay you, companies don't profit that way.

To find insurance companies with the best discounts in Chicago, click this link.

The fastest way that we advise to compare insurance rates from multiple companies is to know the fact most insurance companies actually pay money for the chance to give free rates quotes. All you need to do is take a few minutes to give details including any included safety features, how you use your vehicles, if you lease or own, and your education level. That information is automatically sent to many highly-rated insurers and they return quotes immediately.

If you would like to start a quote now, click here and enter your zip code.

The companies shown below can provide free rate quotes in Illinois. If multiple companies are shown, we suggest you visit two to three different companies to get a more complete price comparison.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Tahoe LS 2WD | $108 | $210 | $294 | $18 | $88 | $718 | $60 |

| Tahoe LS 4WD | $186 | $274 | $262 | $16 | $78 | $816 | $68 |

| Tahoe LT 2WD | $110 | $182 | $250 | $14 | $76 | $632 | $53 |

| Tahoe LT 4WD | $196 | $334 | $274 | $16 | $82 | $902 | $75 |

| Tahoe LTZ 2WD | $138 | $290 | $316 | $18 | $94 | $856 | $71 |

| Tahoe LTZ 4WD | $186 | $322 | $262 | $16 | $78 | $864 | $72 |

| Get Your Own Custom Quote Go | |||||||

Table data represents married male driver age 30, no speeding tickets, no at-fault accidents, $500 deductibles, and Illinois minimum liability limits. Discounts applied include multi-policy, multi-vehicle, homeowner, safe-driver, and claim-free. Estimates do not factor in Chicago location which can revise coverage rates substantially.

Responsible drivers pay cheaper Chicago auto insurance rates

The example below illustrates how violations and fender-benders raise Chevrolet Tahoe annual premium costs for different categories of driver ages. The rates are based on a single male driver, full coverage, $100 deductibles, and no discounts are factored in.

Higher deductibles save money

When comparing auto insurance rates, the most common question is which deductible level should you buy. The tables below may help to illustrate the differences in price when you choose different comp and collision deductibles. The first rate estimation uses a $250 deductible and the second set of prices uses a $500 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Tahoe LS 2WD | $202 | $340 | $262 | $16 | $78 | $923 | $77 |

| Tahoe LS 4WD | $228 | $340 | $262 | $16 | $78 | $949 | $79 |

| Tahoe LT 2WD | $228 | $340 | $262 | $16 | $78 | $949 | $79 |

| Tahoe LT 4WD | $228 | $340 | $262 | $16 | $78 | $949 | $79 |

| Tahoe LTZ 2WD | $228 | $400 | $262 | $16 | $78 | $1,009 | $84 |

| Tahoe LTZ 4WD | $228 | $400 | $262 | $16 | $78 | $1,009 | $84 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Tahoe LS 2WD | $164 | $274 | $262 | $16 | $78 | $794 | $66 |

| Tahoe LS 4WD | $186 | $274 | $262 | $16 | $78 | $816 | $68 |

| Tahoe LT 2WD | $186 | $274 | $262 | $16 | $78 | $816 | $68 |

| Tahoe LT 4WD | $186 | $274 | $262 | $16 | $78 | $816 | $68 |

| Tahoe LTZ 2WD | $186 | $322 | $262 | $16 | $78 | $864 | $72 |

| Tahoe LTZ 4WD | $186 | $322 | $262 | $16 | $78 | $864 | $72 |

| Get Your Own Custom Quote Go | |||||||

Cost estimates assume married male driver age 30, no speeding tickets, no at-fault accidents, and Illinois minimum liability limits. Discounts applied include claim-free, homeowner, multi-policy, safe-driver, and multi-vehicle. Price estimates do not factor in specific Chicago garaging location which can alter rates noticeably.

Based on this data, we can arrive at the conclusion that using a $250 deductible could cost the average driver approximately $11 more each month or $132 a year than quoting the higher $500 deductible. Since the policyholder would be required to pay $250 more out-of-pocket with a $500 deductible as compared to a $250 deductible, if you normally average at least 23 months between claim filings, you would save more money if you choose the higher deductible.

Gender-based auto insurance rates in Chicago

The information below shows the difference between Chevrolet Tahoe insurance costs for male and female drivers. The data is based on no claims, a clean driving record, comp and collision included, $100 deductibles, drivers are not married, and no discounts are taken into consideration.

Tailor your auto insurance coverage to you

When it comes to buying coverage for your personal vehicles, there isn't really a perfect coverage plan. Your financial needs are unique.

Here are some questions about coverages that might point out if you might need an agent's assistance.

- Do I get a pro-rated refund if I cancel my policy early?

- How many claims can I have before being canceled?

- Why is insurance for a teen driver so high in Chicago?

- Do I need to file an SR-22 for a DUI in Illinois?

- Why do I only qualify for high-risk insurance?

- What are good deductibles for a Chevy Tahoe?

- Am I covered by my spouse's policy after a separation?

- Can my teen driver be rated on a liability-only vehicle?

If it's difficult to answer those questions but you think they might apply to your situation, you might consider talking to a licensed insurance agent. To find lower rates from a local agent, simply complete this short form.

Compare rates but buy from a local Chicago insurance agent

Some people would prefer to have an agent's advice and there is nothing wrong with that. An additional benefit of comparing rate quotes online is you may find cheap insurance quotes and still have an agent to talk to. Putting coverage with local agencies is important particularly in Chicago.

For easy comparison, once you complete this quick form, your coverage information is immediately sent to local insurance agents in Chicago who will return price quotes for your insurance coverage. You won't need to do any legwork as quotes are delivered to your email. You can find the lowest rates and a licensed agent to work with. If you need to get a rate quote from a specific insurance provider, just jump over to their website and submit a quote form there.

For easy comparison, once you complete this quick form, your coverage information is immediately sent to local insurance agents in Chicago who will return price quotes for your insurance coverage. You won't need to do any legwork as quotes are delivered to your email. You can find the lowest rates and a licensed agent to work with. If you need to get a rate quote from a specific insurance provider, just jump over to their website and submit a quote form there.

Deciding on an company is decision based upon more than just a cheap price. The following questions are important to ask.

- Do they make recommendations based only on price?

- Does the company have a local claim office in Chicago?

- How often do they review policy coverages?

- What discounts might you be missing?

- Can they help ensure a fair claim settlement?

- Does the agent recommend any additional coverage?

- Can they provide you with a list of referrals?

- Which family members are covered?

If you get good responses to any questions you have and locked in a price quote, most likely you have located an provider that will properly insure your vehicles. But remember, consumers can cancel coverage at any time so never feel that you are permanently stuck with any specific agency for a certain time period.

Final considerations

Insureds leave their current company for any number of reasons including poor customer service, policy non-renewal, high rates after DUI convictions or even an unsatisfactory settlement offer. Regardless of your reason, switching insurance companies can be easy and end up saving you some money.

We just presented a lot of tips how to get a better price on Chevy Tahoe insurance in Chicago. The key concept to understand is the more price quotes you have, the higher the chance of saving money. You may even be surprised to find that the lowest rates are with a small local company.

When buying insurance coverage, it's a bad idea to buy poor coverage just to save money. In many cases, drivers have reduced physical damage coverage and learned later they didn't have enough coverage. Your aim should be to buy enough coverage for the lowest price while still protecting your assets.

To read more, feel free to visit the following helpful articles:

- Understanding Car Crashes Video (iihs.org)

- Who Has Cheap Chicago Auto Insurance for a GMC Acadia? (FAQ)

- Who Has Affordable Chicago Car Insurance Rates for a Hyundai Santa Fe? (FAQ)

- Who Has Affordable Car Insurance Quotes for a GMC Sierra in Chicago? (FAQ)

- Who Has Cheap Auto Insurance for a Subaru Outback in Chicago? (FAQ)

- Teen Driving and Texting (State Farm)

- Five Tips to Save on Auto Insurance (Insurance Information Institute)

- Protecting Teens from Drunk Driving (Insurance Information Institute)